It’s not just the FTC, through. Attorneys General from 17 states have joined in the civil action, bringing cases that allege Amazon’s formidable presence represents an anti-competitive entity that is harmful to both competitors and consumers. Though Amazon strongly denies the charges, you’ll want to understand what’s behind this development. Amazon.com is light years from its humble roots as an online bookseller. Founded nearly 30 years ago by Seattle’s Jeff Bezos, it garnered negative press along with disapproval from fans of brick-and-mortar book stores alike. In what turned out to be a fait accompli, Amazon essentially led the charge of a burgeoning presence of ecommerce vendors weaving their way into the new normal for shopping in the 21st century. Only Amazon went much farther. Discovering the power of Internet commerce, the company grew in unfathomable scope and began selling a wide variety of products. Fast forward to 2023, when there are few items consumers can’t locate on Amazon, thanks to a complex strategy that has increasingly involved third-party sellers. Bezos goes Prime Time Billionaire Jeff Bezos is mostly mum on the government’s lawsuit. After success with the Amazon platform, he’s branched out (bought the Washington Post newspaper) and is a mere figurehead of the Seattle ecommerce entity. Once the iconic Amazon Prime program launched, a star was born, and the ability for sellers to get goods faster (even same-day delivery in some markets) and to take advantage of other benefits (digital content, streaming, music, and discounts at the other Amazon-owned ingenue, Whole Foods). Prime has spurred its own headaches, but that’s another story. A lucrative contract with the US Postal Service and UPS haven’t kept up with demand, and now Amazon uses contracted delivery drivers to pick up the slack. The result is mixed; delivery reliability is suffering in many cases, and some customers cite a reduction in product quality and difficult return policies from third-party sellers. In what the FTC and states are characterizing as a “self-reinforcing cycle of dominance and harm,” the business model of Amazon does raise eyebrows. It’s no secret that the big players tend to apply pressure to stay on top, Amazon is accused of luring both sellers and buyers to its kingdom with underhanded and monopolistic techniques. Once sellers hop aboard the Amazon train to tap into a vast universe of eager buyers, the governments allege, it locks in contractual stipulations that set and raise fees, even punishing sellers who offer their inventory in other venues for a lower price. The Pushback Again, Amazon vehemently defends itself against these claims. It believes it serves both consumers and merchants by allowing them to tap into a massive marketplace where nearly limitless goods are available for mostly free shipping and quick delivery, and ecommerce sellers enjoy an audience reach it could only dream of in the past. As Amazon suggests that regulators seem to misunderstand the nature of retailing, plaintiffs stand strong, citing negative impacts on other giants such as Walmart, Target, and the iconic Internet star, eBay. Yet to be determined is whether the FTC and states envision a breakup of Amazon, separating its currently bundled functions to relieve the monopolistic impact they believe is continuing to the detriment of practically everyone. The lawsuit sits in a Seattle Federal courthouse, awaiting the arduous trail of motions and responses – or perhaps a settlement. Stay tuned.

0 Comments

Ecommerce Giant Amazon Launches New Social Media Tool

And taking the pulse of the younger generation of buyers has inspired Inspire – an Amazon quasi-social media app designed to mimic the popular TikTok. Not surprisingly, it’s an early hit.

Amazon Inspire began a rollout phase in early 2023, offering a downloadable app that in fact resembles the TikTok platform. TikTok is a video-centered app popular across a range of demographics, though it is mostly used by those under 40. That’s where the dollars are, say experts in ecommerce. And that’s where the Amazon future is headed. This intriguing and nuanced app offers so much more than just a small photo on their main website. Amazon shoppers can log in to Inspire directly through their phone-based Amazon app by launching a light bulb icon. It promises personalized content (made possible by a collection of prior shopping choices and probably a bit of data collection from social media use). Users may choose from more than 20 areas of interest such as gaming, beauty products, clothing, pet care, recreational pursuits, and beyond. Browsing the returns that pop up after you’ve chosen a sector, shoppers scroll through buttons to further customize a collection they may find interesting. The experience is similar to TikTok feeds, with engagement buttons and swiping actions that lead to promoted or favored items. This customization feature is perhaps the key selling point of both selling and buying on Inspire. It doesn’t require typing text into a search window. Product categories appear in launchable buttons, and they are diverse. Amazon hopes they will lead you to what you’re shopping for. What Amazon has not disclosed is how the app generates recommendations, except to say that it requires at least two recommendations before it appears as a promoted product. Content creators may enroll in the program to upload media, including video and photos connecting to thumbnail photos of Amazon listings they fancy. These contributors may earn commissions, depending on volume. Customer reviews, always a key element in online sales, are welcomed. Amazon Inspire is now available for use by all US consumers, and the jury is out on how this new, creative approach to a hybrid influencer/advertising function will play out. For now, it appears to be an ingenious method of following the lead in cultural and consumer trends as they develop on the internet. Interested in buying or selling on Inspire? Get more info here.

,Amazon is accused of artificially high price-setting, which is no small problem – for them, and for vendors.

Tempting as it seems, having products show up in a quick search on Amazon’s site appears as an unbelievable opportunity. With exposure as an ever-growing challenge, sales platforms such as Amazon have catered to online merchants and offered a venue with unprecedented visibility. Selling on Amazon seems like a dream come true, until the dark side of the Seattle-based behemoth emerges. Now here’s that dark side. Amazon controls your pricing. Yes, that’s correct. If you want to change what you charge for your products, Amazon can punish you by reducing exposure through search functions. Worse, they can compel sellers to raise pricing on identical products if they also sell on competing sites such as Walmart. An antitrust analyst has made a compelling case for federal review, and the Federal Trade Commission is paying attention. They have signaled an interest in investigation. The State of Washington already obtained a legal victory that partially prohibits the non-competitive feature, but the platform is finding ways around that. It disposed of the “Sold by Amazon” program name, but in name only will not end other variations of the practice. Amazon paid a $2.25 million fine in January 2022, but in relative terms, that is a pittance. California has also zeroed in on Amazon for its monopolistic policies, filing a federal antitrust suit in September 2022 challenging merchant agreements. The company has not publicly responded to California’s lawsuit, and it will be interesting to see if this one puts teeth into the Washington action. The problem unfolds in a way that sellers have virtually no control. Obviously, it’s a boon to have access to the expansive reach of the largest e-commerce site in the world. But if the offset is to be locked into pricing policies or face relative invisibility, you have lost the benefits of using Amazon. The Catch-22 is a persistent issue facing both smaller and mid-sized retailers who are struggling to find market share. Surely there is a way to find middle ground. Will high-profile platforms ease up on small sellers and institute a more fair way to accommodate them? Stay tuned. And look for independent marketing strategies in the meantime. They didn’t name it Amazon for nothing.

As if the king of all internet retailers hasn’t dominated enough sectors, it’s now among the top platforms for advertising. There are good reasons for that, and none of them should be a surprise. Just as Facebook took the social media world by storm, effectively lining out competitors, Amazon is well on its way to becoming the premier commerce player of all time. Aside from negative press surrounding unfortunate stories of porch package thefts, their rep is quite stellar, even as they creep toward a quasi-monopoly territory that has retailers concerned. And why not? Eclipsing the 600 million product mark in 2018, it seems there isn’t much you can’t find on the popular site. Add to that two-day delivery with its Prime feature, and you have a massive cabal of captive targets. More than 300 million of them, to be exact. This is where you come in. Whether or not you use Amazon as a sales platform, you should be giving serious consideration to its advertising feature. Not too much of a departure from Google Ads, Amazon creates a seamless search function for site users to locate a product. Sponsored posts appear at the top, designated as such in a subtle way. That puts your offering front and center to a consumer directly searching for it on a favorite portal. It’s a new year, and a new chance to evaluate your strategies as an ecommerce player. Maybe you’ve noticed the proliferation of ecommerce giant Amazon.com, which is quickly becoming the Microsoft of the computer sector. Amazon CEO Jeff Bezos is determined to dominate the online sales market by expanding offerings and by snatching up ancillary entities such as delivery services.

What does this mean for you? More opportunities. And approaching the Amazon sales model is always a wise choice; by all accounts, they are the venue of choice, surpassing even eBay for vendors of new merchandise. Ecommerce experts estimate that 2 million sellers sold more than 1 billion items on Amazon in 2015. That number is expected to escalate quickly. Amazon’s sea of opportunity is competitive. There’s no getting around that. If you’re peddling goods that are not custom-made, it’s likely you’re going up against other sellers who may be larger and selling at volume, or smaller and willing to accept a lower profit margin. All of this means you’ll want to keep an eye on your bottom line—your pricing. The most customer-friendly policies and business model in the universe won’t lure pure price-shoppers away in many cases. This doesn’t mean you should be forced to undersell yourself, but just to make sure you’re offering a deal you can live with. Enter Amazon “repricing,” or a tool Amazon uses to push their own branded and sponsored merchandise above yours. They scan pricing for like items by using automated analytics software, and reduce their pricing accordingly. Does this put you at a disadvantage? Yes. Is it insurmountable? No. Why? Because you also have access to that strategy. There are several apps and programs out there that allow you to track pricing of the goods you sell on Amazon. You may adjust pricing the minute Amazon does, and also monitor your third-party competitors. To honor the start of a new year, we’ve identified four tech companies that we expect to make a huge impact in the retail space in 2018.

Amazon is seemingly at the center of the Internet, but for up-and-coming entrepreneurs aiming to put a product in customers’ hands as soon as possible, there are young companies that are working to make retail tasks less intimidating. Get ready for another significant development in the world of ecommerce. In what may be an inevitable move across platforms and functions, a marriage between social media apps and online retailing is taking shape.

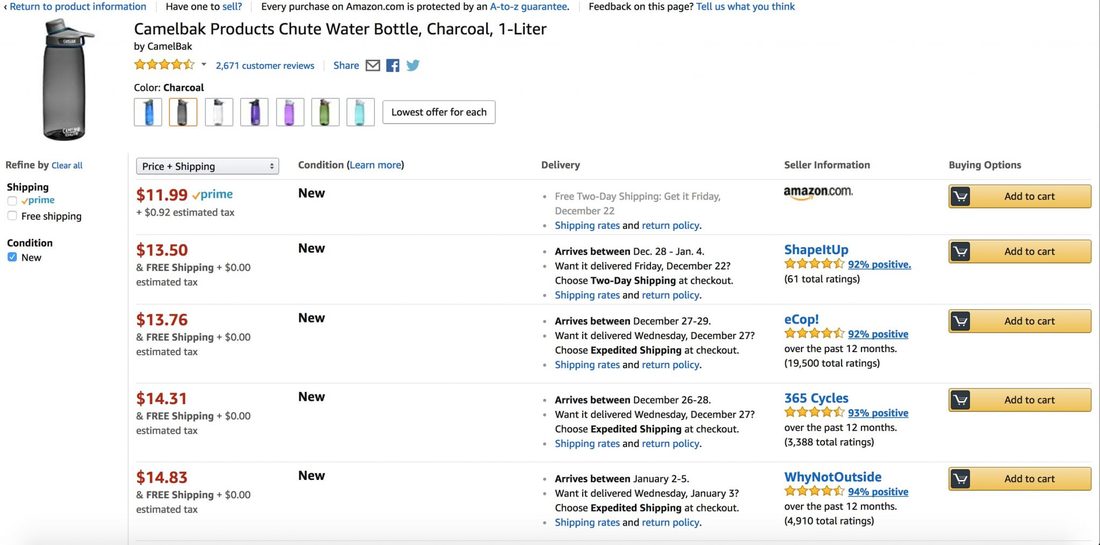

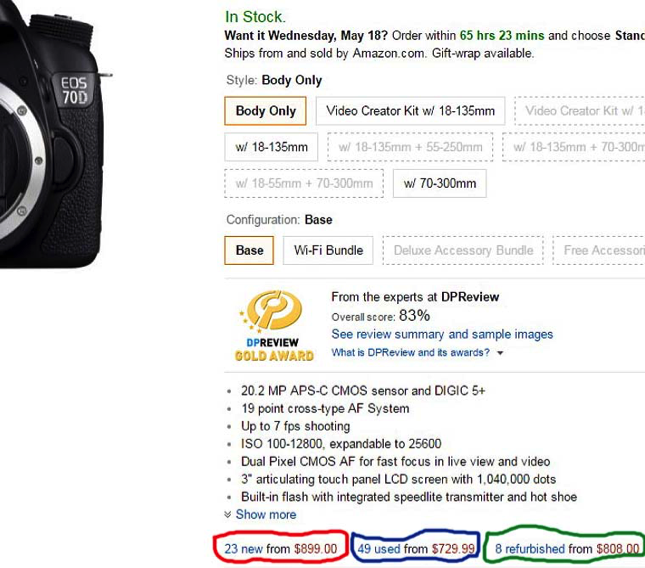

You’re already familiar with the dominant entity Amazon, a pioneer in harnessing the Internet’s reach and turning it into a multi-billion dollar business that involves re-selling, and only re-selling. Since its 1994 start as primarily a bookseller, it has reached the epicenter of mass global selling. It is the Walmart of ecommerce. And now it sports a tentacle aimed at luring the busiest corner of the internet: social media. Think of the time and energy spent on creating the online store of your dreams. Web design, categorization, ordering functions, payment processing— it’s an uphill climb, but once it’s done and you’re actually a player in the online retailing business, you can feel like a million bucks. That’s why may seem counter-intuitive to hand off some of your sales and marketing functions to a third party. Independence was your goal, so stepping backward feels awkward, right? Not necessarily— not if that third party is an e-commerce giant that can boost your bottom line. Now in its 22nd year, Seattle-based Amazon.com is the largest online retail entity in the United States. With its own rather amazing story— Amazon has yet to turn a profit despite its wild popularity— its reach into American homes (and those around the world in separate retail companies) is astounding. In part due to strategic and creative features such as Amazon Prime, a membership-based offering, Amazon commands an enormously loyal customer base. The company continually expands benefits available to Prime members, including a subscription to television and film content, and music streaming, plus free 2-day shipping. Put simply, Amazon has done the work for you as it widens your exposure in ways you never dreamed possible. It boasts an estimated 85 million unique viewers every month. Why wouldn’t you jump on board as a seller? Compare it to another high-volume sales platform: eBay. Originally launched as a venue for collectors and small-time peddlers to off-load wares, it has grown into an online presence nearly dominated by wholesalers and retailers. And while its early days featured items for auction only, all sellers are given the option to list merchandise for straight sale. But unlike Amazon, eBay customers are less attached to that platform as a brand. Amazon users are familiar with its layout and comfortable with the ability to conduct accurate, efficient searches. Those searches are a hot selling point for e-commerce vendors, but the beauty of using Amazon as an alternate platform is its dominance in internet search engines. Plug in a product name to a Google page, and chances are excellent that the first retailer popping up will be Amazon. If you happen to be pitching an item in that category, your challenge just became easier. Amazon’s base offerings are usually proprietary. But vendors selling the same products—new or used— are treated to a teaser feature on the product’s main page. In this image, you’ll notice active links that take shoppers to the same item available from Amazon sellers: Should a buyer choose to venture beyond Amazon’s offering, they will find a list of vendors offering the same product, rated for condition, price, and shipping options. This is your opportunity to sneak in as a viable option for discerning customers.

While price appears as an enticement, the beauty of Amazon is its focus on features over costs. In general, Amazon shoppers value reliability and selection over bottom-basement pricing. Their objective is to find a quality product at a decent price, and experience seamless purchasing and delivery. This is good news for sellers who want to avoid branding as a cheap discount outlet. There are practical pluses to choosing Amazon over eBay, including the ability to load bulk listings more quickly, and to bump up your prices just a bit over what you will sell for on your site. Naturally you will want to factor in the fees handed over to Amazon once you do make those sales. Their fee structure is complex and varied, and you will want to study each option to find which—if any —works best for you. Another important point is performance. Yours, not theirs. Amazon is far more aggressive in monitoring quality and shipping time, soliciting input from customers and featuring product and vendor reviews on the listing page. The reviews are more in-depth, and are longer, than the cursory eBay feedback windows. This can be a blessing for those who are confident in what they sell and how they move their product from warehouse to the customer’s home. Finally, nothing beats the fulfillment of building a clientele that may never have found you were it not for your decision to take advantage of a mammoth e-commerce presence like Amazon. Your reputation gets a boost by proxy, and customers looking for niche products just may fall in love with your individual store if you make their buying experience a pleasure. Don’t take our word for it. Ask around, hop online to explore on your own, and go straight to the source. Amazon is happy to offer primers that will walk you step by step into their fold. Should you decide to jump on board, and your experience is ultimately positive, there’s no reason you can’t maintain a dynamic online presence while padding your sales volume through affiliating with the King of E-Commerce. |

Archives

October 2021

Categories

All

|